Paying the last instalment on the loan is indeed relieving. It is an achievement you must celebrate! Making regular payments on a quick loan requires financial discipline. Skipping one attracts multiple charges, increased interest, and penalties. Well, you successfully got through that! You no longer need to pay a lump sum.

However, you can still benefit from that! It is because paying off a loan does not end your financial responsibilities. It is instead time to re-check your finances and repair them from the beginning. If you're clueless about what to do after paying off a quick loan, read ahead!

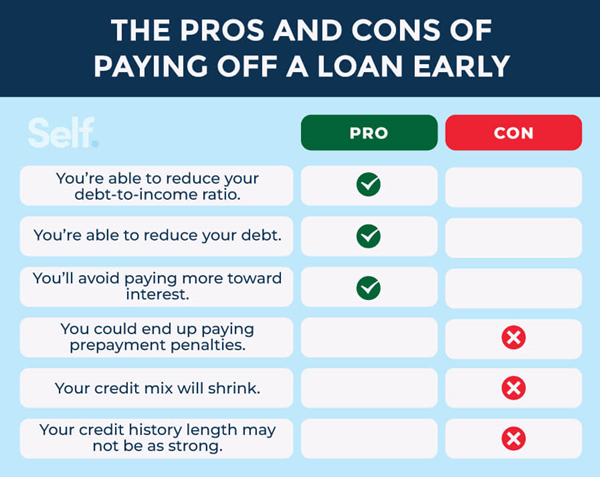

Yes, most loan providers allow you to clear your dues before the loan term ends. It helps you save on the interest cover and the total amount you pay on the loan. Paying off a loan early is good for your credit score, too.

Always check for the pre-payment fee before seeking a quick loan online with instant approval. If the creditor charges one, paying off a loan early may prove costly. In that case, it may affect your finances and credit score if you cannot pay the dues.

If confused, you can also check the possibility with a paying off a loan early calculator. It helps you know approximately how much it will cost you if you decide to pre-pay. It is advisable to confirm the possibilities of overpayments from the loan provider before taking any action.

The first thing to consider is the dip in the credit score. Paying off a loan affects your credit rating temporarily. It is especially if it was an old pending quick loan. Your credit score may return to normal after some time. However, for that, you must keep up with the other payments without skipping any. Otherwise, you may not see the improvement that you want. Here are other steps to take after paying off a loan:

Paying a debt does significant changes to your credit score and the mix. Therefore, it is wise to request an updated one as soon as you pay off the loan. It helps you analyse the positive changes and take the necessary steps.

Moreover, an updated one may help get an urgent loan in a timely manner. You don’t need to wait until the agency provides it. It is because it may take around 30 days to get the updated credit report. Thus, pay off your critical debts meanwhile and apply for an updated report quickly after paying the debt.

Pre-paying any loan promises significant savings on the interest and total amount. Thus, you get the amount transferred to your specific bank account. Here is how you can make the best use of it:

An emergency fund is a savings account that you must have for critical life circumstances like unemployment. Save some amount towards it.

If you are willing to buy a car or a home, a deposit reduces the liabilities. Thus, you can put some towards the deposit to get a cheap loan quote.

You can repay high-interest credit aspects like credit cards, payday loans, overdrafts, or anything affecting your credit score. It helps you bring down the credit utilisation rate drastically. It is a good signal for your overall finances. It is because you will then be able to get credits affordably.

Paying dues requires you to stick to a stringent budget. You may have skipped desires that you wanted to achieve at that moment. Don’t worry, now you have all the flexibility to do that. However, make sure it does not affect the basic lifestyle needs and the payments.

A budget helps you balance that perfectly. Here, consider your next best goal after paying off the quick loan. It could be buying furniture. Okay, so you must ensure sufficient flexibility to save for the goal in the budget.

Keep your wants to the bare minimum and make a need-specific budget. Ensure a good scope for saving for the furniture. Trendy ones cost a lot and may take time to save. Here, you may either consider personal loans or set a time frame.

A personal loan may help you achieve your goal, alongside repairing your credit score and finances. Alternatively, you can set a specific time by which you must save for the furniture purchase. Saving a fixed amount helps you achieve a goal better.

Your income must be great, as you paid off the quick loan on time. However, you must keep growing in your career field and income. It reveals that you are serious about your life goals. Thus, check better income opportunities if you don’t find one within your current company.

Explore the horizons to get a better understanding of the job market. Check how much you can get by skilling up. It will help you improve your income and achieve other life goals without obstacles. However, one struggles to save money even with a good income. It could be due to prioritising long-term investments.

If most of your money is invested in long-term goals, it leaves little flexibility. Don’t worry, check the best loans in Ireland for quick cash. Use it to meet critical needs anytime and from anywhere. You get it the same day.

Getting a loan and paying it off timely grants sufficient experience in credit management. Therefore, you must look ahead and analyse your short and long-term goals. Make a list of the goals that you want to achieve and the time frame you want to achieve them in. For example, if you are 20, the list may look like this:

|

Life goals |

Time frame to achieve it |

|

Buying a car |

By the time you turn 23 |

|

Purchasing a home |

By the time you turn 28 |

|

Starting a business |

By the time you turn 45 |

Similarly, you can create your chart according to your specific life goals and save accordingly. It will also help you understand how much you need to achieve a goal. Accordingly, you can explore your options.

Thus, paying off a quick loan is not the end of the financial journey. Instead, it comes with new financial challenges and goals. Analyse your money matters after the loan clearance. Check whether you get the loan completion documents in writing. It eliminates the possibilities of confusion on either side.