According to RTE, women tend to have a far lower sense of confidence in their decision-making ability in comparison to men. Only 39% feel confident about investing money rightly and making specific decisions.

Also, PTBS feels that men are twice as likely to invest as women (33% men, 15% women). 48% of men have a clear long-term financial plan, compared to 35% of women. However, 70% of women are good at grocery shopping compared to 39% of men. This data clearly shows women’s discomfort with investing, even though they can manage basic lifestyle needs with ease.

As per facts, “ many women reported negative impacts due to the five-week wait for Universal Credit. Many needed to borrow money from friends (61%) or direct lenders (25%) to survive.”

It is because taking a personal loan in Ireland helps one finance immediate and short-term needs, such as paying bills without delay. It grants one the opportunity to strengthen the financial position as a woman and avoid severe circumstances that may follow.

At the same time, some had to cut back on essentials/ extras to meet basic needs. What more? “18% resorted to selling their possessions to meet requirements.”

However, it does not mean that women cannot manage finances. Some aspects showcase women’s financial strengths in the wrong light.

According to Accountancy.ireland.ie, “ The proportion of female chief executives among the Chater’s 100 signatory firms has risen to 22.6% from 19.4% in 2023.” Here are other facts to know:

Ireland sees a 5% increase in women occupying senior management roles, from 6% in 2024 to 11.7% in 2025. Moreover, the country is performing better than other European countries in terms of women in senior management positions.

According to esri.ie. “female CEOs in signatory financial firms are about 22.6% in 2025. It increased from 20% at the Chartered inception.”

The female share of internal managerial appointments (49%) is higher than the female share of external appointments (44%). This suggests that promotion and internal processes are important for increasing gender balance in the firms.

If reading as a man, the blog may help you understand the myths that shape the societal perception of women. As a woman, you may get to analyse the truth behind the false façade that weaves the pattern of women’s existence and financial dominance in the country.

Here are 5 common money myths about women in Ireland. It will help you know what the real picture looks like:

Undoubtedly, investing is a man’s game. It is risky, and definitely not for the faint-hearted. However, recent data shows that women have been excellent investors.

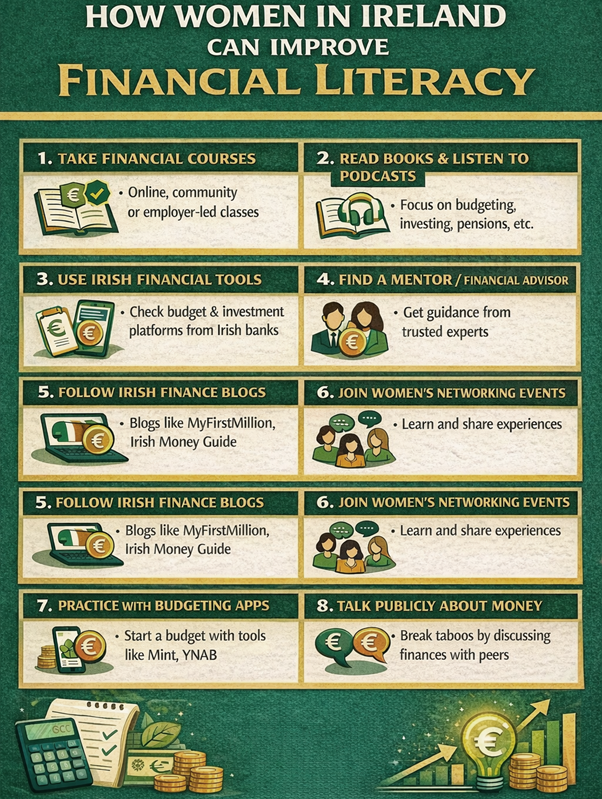

Although only 15% women share full confidence in investing, they top in research. Women are excellent at researching, analysing and long-term planning. However, getting the right set of advice at the right moment may help them progress and learn the basics.

How can women improve at investing money?

This notion or myth is based on a sexist approach. Women are often emotionalised due to their basic form. However, this is not true. In fact, most women are better at budgeting, planning, saving, and managing debt than men. Instead, they serve as a primary financial organiser for household finances.

Certain beliefs strengthen the myth. According to her. i.e. reports:

These beliefs are from the real people on the streets of Dublin.

Some believe that Ireland exemplifies equality in salaries for men and women. However, there is a huge crack that needs to be refilled. Still, women receive lower pay than men for similar services.

Ireland's gender pay gap report states, “ 80% men receive bonuses in kind in comparison to just 20% of women in the same range.” Moreover, the hourly remuneration for the highest paid employees is “25.1% for females in comparison to 74.9% male.”

This wide gender pay gap continues to widen and impact the long-term financial inequality in savings, pensions, and overall wealth.

There is a long-standing cultural expectation that women should prioritise others’ finances over their own. However, the reality is that strengthening personal finances is more important than considering or uplifting others.

Otherwise, it may jeopardise the financial security, leaving women in a more complicated state. Effective personal finance management helps support both household and individual growth. Women can do that by:

This is not true. Only 1 in 3 women can plan retirement comfortably. Here are some facts to know:

What changes may strengthen the financial position of women in terms of pensions?

These are some financial myths that affect how women are portrayed in a financial mirror. This needs to be changed, and analysing the reality behind the myths helps with that. Women are good at budgeting and managing small expenses, such as groceries. However, they also demonstrate tremendous proficiency in managing official financial matters.