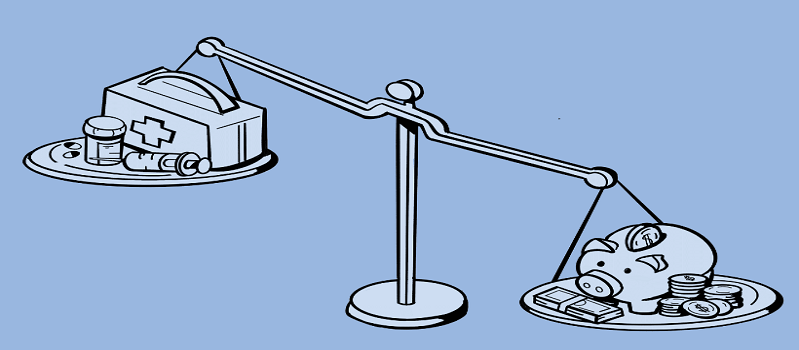

Health care gets pricier year after year. It really squeezes budgets tight. Insurance premiums climb up and up. And out-of-pocket costs like deductibles do, too. For folks living on fixed incomes, it's a huge struggle. You can sort of plan for those premium payments. But then, surprise medical bills wallop your finances.

Maybe you need an emergency surgery all of a sudden. Or perhaps you landed in the ER after a bad accident. The portion you owe can easily total thousands! These soaring costs push many into debt. Even with insurance, you might go broke from a single hospital stay. It's no wonder medical issues cause so many bankruptcies.

The smart move is finding affordable ways to stay on top of preventive care. And having a backup plan when major expenses hit despite your best efforts.

Choosing the right health insurance is no joke. Honestly, it's pretty overwhelming with all the plan options out there! But doing your homework pays off hugely. Let's break it down:

The monthly premium is that set amount you pay every month, no matter if you use medical services or not. It's the cost of admission for having coverage. And yeah, those premiums can really vary!

You might see one plan advertising low £200 monthly premiums. While another comparable option clocks in at £500+ per month. Quite the spread, right? Don't just automatically choose the cheapest though.

Lower premiums usually mean higher out-of-pocket costs if you actually need decent medical care that year. So you've gotta calculate the total potential hit with high deductibles and copays too.

You owe the deductible out of your pocket before insurance kicks in their portion. We're talking anywhere from £500 deductibles up to £7,000 or more! No joke.

Obviously going with the lowest premium plan sounds tantalising. But if it carries a mega high £6,000 deductible, you're stuck shelling out tons before you see any coverage. Not ideal when cash is tight.

And even after hitting that deductible, you still pay copays for office visits, procedures, and medication. All insurance plans handle copays differently too.

For those of us maintaining regular prescriptions, this is a huge cost factor to dig into across each plan option. Most insurance companies sort medications into pricing tiers, such as generic, preferred, non-preferred, and speciality drugs.

You might pay £10 for generics, while non-preferred medications can be really pricey, at £60+ for a 30-day supply. And good luck affording speciality medications without coverage—we're talking hundreds or thousands!

So, definitely create a full list of your and your family's medication needs. Look up how each plan covers those specific drugs across its pricing tiers. This will show you the total annual drug costs per insurance option.

What if you're low on cash but need medical care? A personal loan can help cover those huge out-of-pocket costs. Don't worry about poor credit either. Many lenders provide personal loans with no strict credit checks nowadays.

Applying for a personal loan with no credit check is swift and easy online. Simply apply and get approved fast. You'll receive the cash in just days to cover urgent healthcare needs. Repayment is affordable too - you get several years to pay it all back gradually.

Just make manageable monthly payments that fit your budget. It's way better than putting medical debt on high-interest credit cards. Those pile up so fast! A fixed-rate personal loan lets you budget properly.

Interest rates are higher for bad credit borrowers. But it's still smarter than credit card debt cycles. A personal loan is like a lifeline bridging gaps when medical expenses strike unexpectedly. No need to skip important treatments due to costs.

Staying on top of preventive care is so important! Getting routine check-ups helps catch potential health issues super early before they snowball into bigger problems.

Think about it - taking your car in for regular maintenance helps prevent breakdowns, right? Same idea with your own body! Don't neglect this valuable preventive approach.

Most insurance plans cover an annual comprehensive physical exam 100% free. It's included as preventive care! This yearly visit lets your doctor establish baseline levels.

They can identify any concerns or negative changes from the previous checkup. Things like increased cholesterol, blood pressure, weight fluctuations and more. Addressing these head-on prevents complications down the road.

Plus, you can discuss any other symptoms you've noticed. Docs often spot patterns and make connections you might miss yourself.

Seeing your dentist every 6 months for cleanings does so much more than just polish your pearly whites. Your dentist examines your whole oral cavity during these appointments.

They keep an expert eye out for any signs of gum disease, oral cancers, and other developing issues. Catching and treating problems early in the mouth prevents them from spreading into bigger overall health concerns.

Regular cleanings and checkups also remove built-up plaque and tartar - lowering risks of tooth decay and gum inflammation. Such an easy preventive step!

Do you want to apply for a loan online? Applying for a personal loan completely online is incredibly convenient these days. No more time-consuming meetings or stacks of paperwork at a bank branch! Just a simple digital application process.

Most online lenders have user-friendly websites and mobile apps that walk you through everything. You just provide some basic personal and financial information. Many can even integrate bank accounts for faster verification.

The whole application takes 10-15 minutes tops from any device. You'll receive a lending decision almost instantly too - no more weeks of waiting around! Approval rates tend to be higher than traditional banks as well.

If approved, you electronically review and e-sign the loan agreement documents. This locks in the loan amount, interest rate, repayment schedule, etc. Many lenders then deposit funds directly into your bank account within 1-2 business days!

The entire process is paperless and can happen 100% remotely from start to finish. No phone calls, no faxes, no visiting a physical branch location ever required. Applying for a personal loan online is fast, easy, and transparent.

The best is preventing those huge bills! Use generic drugs instead of brand names. They work just the same but cost way less. Apps show cheap pharmacy prices, too. Get all the free preventive care your plan covers. Annual checkups and cancer tests are included. Catching issues early avoids bigger costs later. Being proactive pays off big.

Finally, shop around for the best prices. Don't just use the closest doctor. The same services cost differently everywhere. Comparing prices leads to major savings. With smarts and personal loans when needed, quality health care fits the budget. No more putting off treatment due to costs!