You have won half the battle if you have successfully negotiated for the best price. You will need an auto loan if you do not have money to pay for it outright. Shopping around and comparing deals can help you choose the most affordable deal. Getting a pre-qualified approval letter from at least three lenders […]

Read more

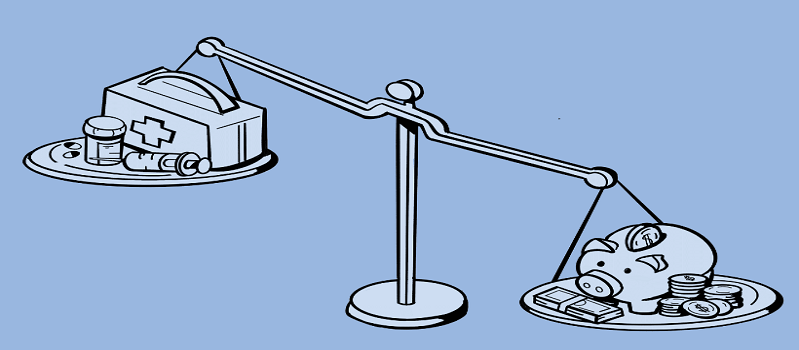

Health care gets pricier year after year. It really squeezes budgets tight. Insurance premiums climb up and up. And out-of-pocket costs like deductibles do, too. For folks living on fixed incomes, it’s a huge struggle. You can sort of plan for those premium payments. But then, surprise medical bills wallop your finances. Maybe you need […]

Read more

You cannot stop inflation and cannot avoid dealing with it. There is something you can change in our way of living. Some life skills that you have never thought would come in handy when times are hard, and money is everything. The art of doing your things is rarely found, but you can master multiple […]

Read more

We often hear useful advice that you should save at least three months’ worth of living costs to get by smoothly during financial emergencies, but unfortunately, it falls on deaf ears. Inflation rates have refused to let up, and they do not expect to hit normalcy in the next few years, meaning your struggle with […]

Read more