When you have no solution left in your mind of what to do and how to do then following up on situations should work. It is because there are times which you have to look for varied reasons to make sure of the fact that people wanted to understand its perspective. When you know that planning out deals becomes an easy gig to carry, then you must consider the thing.

The briefing of many reasons punches to one significant trouble always. That is why you have to switch for reasons to counter. If you stuck at a place that gives you no room to think of getting the aid of funds, then the online platform stands to rise for the situation. To give your team a significant impact, you should know everything about getting the financial source.

Therefore, you have to understand and think of a solution that helps in giving you areas that work upon is the performance of credit score—the role of a credit score function in a way that brings the management of funds precisely.

It is always in individuals minds that to get the borrowing, you have to present good income, but when you apply online, there is a change. It is because when you perform any borrowing that should acquire in one go and that is the reason for your consistency of work. By taking the specific situation at ease, you have to plan out everything carefully.

It is because the credit score is an important task, and that is because you plan out the deals of the functioning you can get instant approval. But there are situations which you have to consider while dealing with credit score is your conduct.

When you know that you are going to take the hype of managing the funds, there should be a proper ideal to follow. The maintenance of credit score shows how loyal you are in making your financial background durable. There can be two stances to cover, such as:

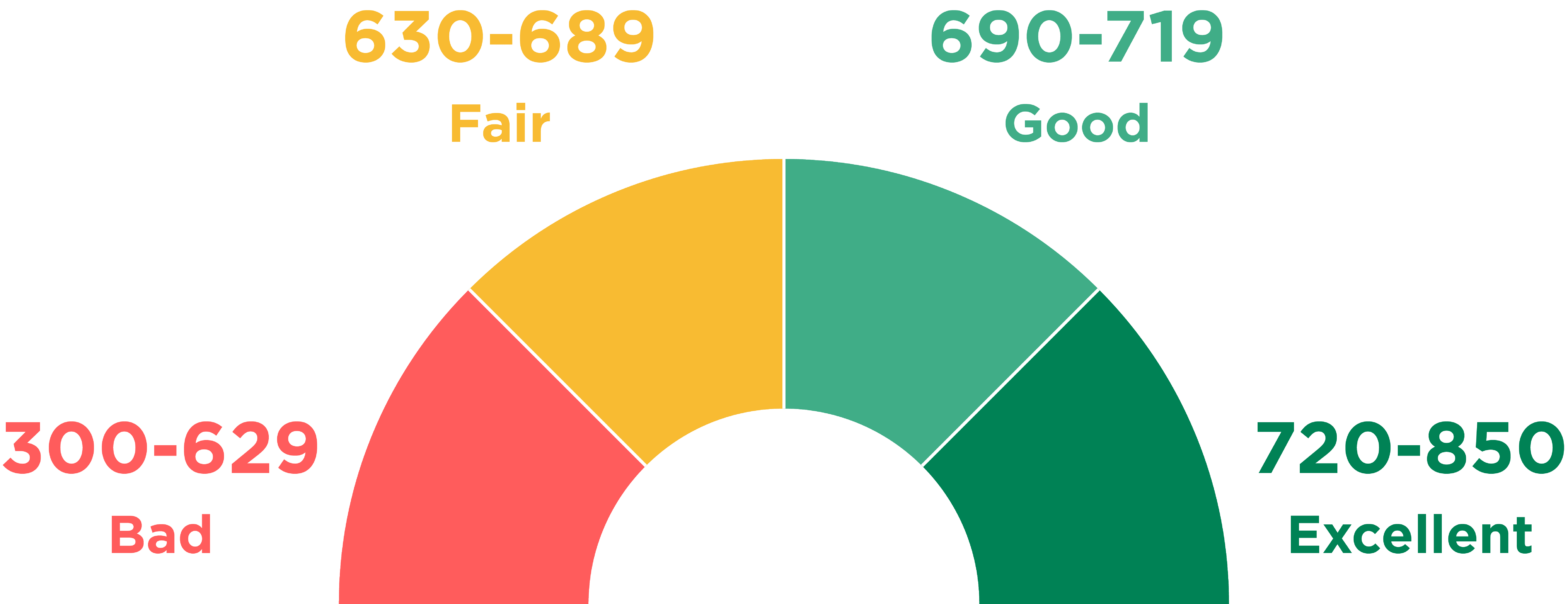

There are different sites that you can cover and check the credit score. You can search for the Irish credit bureau whereby filling all the essential credentials you can get the ratings of the credit score. You can check the pattern here:

To improve the credit ratings, you can switch to expand your arms by working more. When you work more, there is a possibility of earning the maximum amount, which can become easy for you to deal with. Therefore, there is a possibility of working that you can manage the juggle of credit score by making on-time repayment you can achieve the financial outcome.

| Score | Lowest Score (Highest Risk) | Highest Score (Lowest Risk) |

| ICB CRIF 4* | 276 | 581 |

| ICB CRIF 3* | 224 | 545 |

| ICB CRIF 2* | 330 | 550 |

To recapitulate

With the programmer of making the best of the financial outcome, there are reasons when you know to understand. When you know that you have to practice the funds then keeping credit score in hand gives you better options to get the right amount and instant approval.