Fast loans are a wonderful option to meet short-term financial requirements. You can fulfil many needs with fast loans if you don’t want to spend your savings. These can be like medical emergencies, unexpected home renovation, long-awaited travel, or a dream wedding.

Earlier banks were solely taking care of providing loans to individuals with, of course, the lengthy procedures that consumed their whole precious day.

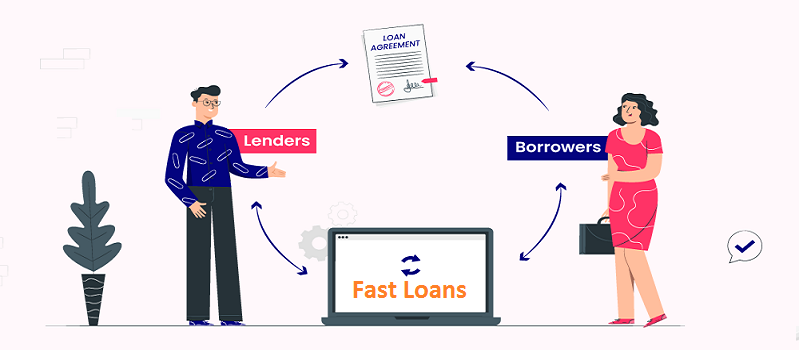

Thanks to digitisation, which accelerated after the pandemic, made activities like paying bills, shopping, online classes, etc. easy. Among many other things applying for a loan has become an instant click.

Let me ask you a question, are you prepared for any financial emergency right now? If the answer is No, then this blog will help you make financial decisions easy regarding taking out a fast loan in Ireland.

From managing the increasing school fees of your children to celebrating your marriage anniversary, which is around the corner, fast loans offer financial help on an instant basis. If you want to come out of the financial tangle, let us learn the quickest ways to take out fast loans in Ireland.

Decide the amount: The first step is to analyze your financial situation and decide how much money you want to borrow. Make your mind on what amount of money you need according to your present state and follow the next procedure.

Apply online: You don’t need to be physically present to complete the procedure. You simply need to visit the mycreditbucks.com website, fill simple online application and complete the procedure within a few seconds, sitting at your home.

Quick approval: We don’t believe in wasting your time, so once your request is received, we take less time to approve it. After this procedure, you get the required money into your bank accounts on the same day.

Now you know how to get a fast loan quickly, but you must be thinking about where to use it. There are various needs that you can fulfil by simply taking the fast loan.

Unexpected emergencies are something inescapable, and having an option like a fast loan helps to stay afloat. Let us understand more by learning its beneficial features:

Although fast loan cash can be availed at your ease, you should know how it works before applying for it. Also, don’t fall behind when it comes to loan repayment, as it seriously damages your credit ratings.

In addition, it highly affects the ability to get another loan, mortgage, or other forms of lending in the future.

If you have decided to opt for fast loan cash, you should always compare multiple money lenders to get the best deal at the lowest rates. Most money lenders in Ireland allow you to see the potential interest rates on a particular loan plan without checking the credit report.

Once you find your loan provider, you will have to fill up an online application form with personal details and other verification documents. If everything goes well, the next process is very quick, and you get the required funds in your account within a few days.

Fast loan cash can be quickly used for almost everything. That is why it is called ‘fast’ loans. Keep in mind that the loan repayment must be made within the pre-decided time.

Whether you are looking for quick loans, or need cash urgently, taking out fast loans in Ireland has become very easy. Fast loans are one of the ideal ways to improve the small financial problems and take care of short-term needs, undoubtedly!