A decade ago, who'd have thought that trading in a cubicle for a café in Bali would become a legit work setup? Yet here we are, with "location-independence" not just a buzzword but a lifestyle.

The rise of the digital nomad stems from a cocktail of tech advancements and a thirst for a work-life blend, not just balance.

But it's not all sunshine and ocean breezes. This is especially true when it comes to managing money.

Here's the snag: Most financial structures are designed for static living. Digital nomads, with their perpetual motion, face distinct money hurdles.

Think multi-currency accounts, unpredictable expenses, and the good old tax tangle. Have you ever tried keeping up with the fiscal laws of five countries in a year?

The allure of the digital nomad lifestyle is unmistakable. Sun-soaked beaches one week, bustling urban landscapes the next.

While the ethos of a nomad is movement, having an anchor is invaluable when it comes to finances.

Your Credit Story: Every Transaction Tells a Tale

Here are some tips to easily qualify for personal loans in Ireland!

Building Local Networks: It's not just about global travel; it's also about local roots. Cultivate relationships with Irish businesses or community groups. This can significantly elevate your profile in the eyes of lenders.

It's not just about the numbers but also the law. Ensure you're up-to-date with tax obligations and visa requirements in every country you traverse.

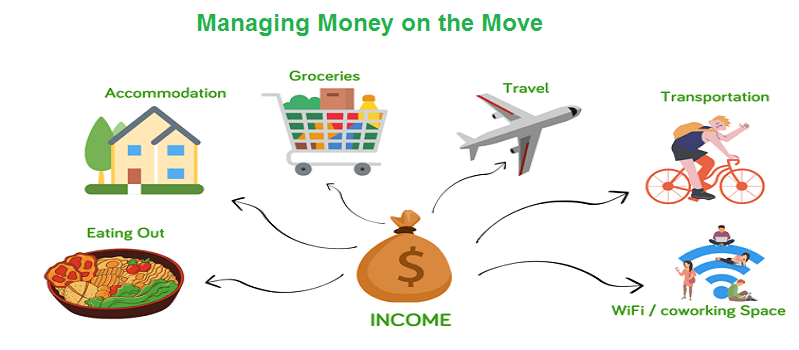

The digital nomad lifestyle is peppered with panoramic vistas. But beneath this picturesque surface lies a constant: the challenge of financial management. Being on the move means variable living costs and unplanned expenses.

Budgeting isn't just a good-to-have skill; it's a vital compass for every digital nomad.

Now, despite the most meticulous planning, there can be instances when finances exceed budgets. Maybe it's that irresistible local experience or an unplanned adventure. In such scenarios, where the deficit seems temporary and you find yourself in Dublin, there’s a solution to bridge the gap: cash loans in Dublin. They can be a quick, short-term fix, ensuring that your journey continues unabated, with minimal hiccups.

In the grand tapestry of nomadic life, financial preparedness is the thread that holds it all together. Safe travels, and may your financial compass always point you in the right direction!

If you are a digital nomad, it might seem cool, but investing might seem hard with this lifestyle.

Secure Future: While you're exploring now, you'll need funds for later.

As a nomad, taxes can be tricky. Different countries, different rules. Always check local tax laws before investing.

Read Often: The financial world changes a lot. Stay updated. Read news, articles, or even financial blogs.

Every investment has risks. Plan for them. And remember, higher risks can mean higher rewards.

The digital nomad life is like a two-sided coin. On one side, there's so much freedom. Imagine working from a beach or a cosy café in a new city! But, just like any coin, there's another side.

And for nomads, it's a challenge. Things like finding a stable internet connection or understanding local prices. What is one of the biggest challenges? Managing money? It is where being proactive comes in.

This will help avoid surprises and let you enjoy your travels more. So, while the nomad lifestyle is exciting, it is staying on top of your money game is essential. It's like setting the GPS before a long drive.